There's additionally an opportunity that home loan rates might stagnate in the direction that you're westlake financial español número anticipating it will, or it may stagnate as high as you believed it would. As an example, a 10-year set home loan price could be at 5% while a 5-year fixed mortgage price might be at 3%. There are other factors to consider to your home loan term size besides just the home loan rate. Damaging your home mortgage, which occurs when you market your home and also step or renegotiate your mortgage prior to completion of the term, will certainly feature considerable mortgage early repayment fines. You will be able to avoid home loan charges if you wait till your term runs out.

- Renewing your mortgage entails signing for another term with your existing lending institution.

- Presently, home loan insurance is just offered for houses under $1 million.

- The a little greater home mortgage rate could be rewarding for not having to stress over interest rate fluctuations.

- If the prime price increases to 2.8%, your variable home loan rate will certainly now be 2.30%.

A mortgage broker can assist you to identify the ideal home loan product based upon your economic circumstance. They can work out for the very best rate on your behalf with a mortgage lender, aid you with all needed documentation, as well as answer any type of inquiries that you could have throughout the home mortgage process. The home loan process can be stressful, but it doesn't have to be. After reviewing this write-up you ought to be better prepared the following time you request a home loan. By understanding specifically what home loan lenders will certainly be checking out, where you should look as well as what you must expect, the process will certainly go a lot smoother.

Just How Much Mortgage Can I Manage?

Guaranteed financial investment certificates are issued by Royal Bank of Canada, The Royal Count On Firm, Royal Trust Company of Canada and Royal Bank Home Loan Firm. Royal Bank of Canada, The Royal Count On Firm, Royal Count On Firm of Canada as well as Royal Bank Mortgage Firm are members of Canada Deposit Insurance Coverage Corporation. Down payments with any of these establishments are eligible for CDIC deposit insurance policy coverage offered they are payable in Canada. To find out more, including conditions of coverage, get in touch with CDIC straight at or 2342. Interac e-Transfer purchases are free for all RBC personal chequing accounts. A fee of $1.00 might be charged to the sender for Interac e-Transfers sent out from RBC individual savings accounts detailed as a Qualified Account.

Cmhc Insurance Coverage

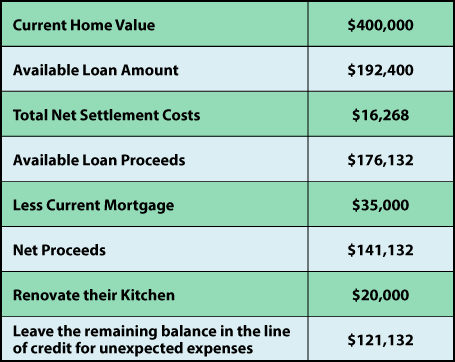

That way you can fairly look at each home when making a decision if it's ideal for you. As soon as you have actually decided you 'd like to buy a home, the next step is to figure out exactly how to spend for it. Unfortunately, most of us don't have the money conserved as much as get a residence outright. Sign up for our monthly newsletter to get inspirational way of living tips to optimize your retirement. Home equity is obtained by deducting any kind of outstanding protected financial debts against the house from the appraised worth of your residence.

Other Certification Criteria To Obtain A Home Mortgage

While your routine repayment will certainly continue to be continuous, nashville grand prix tickets your rate of interest might change based on market conditions. When prices on variable rate of interest mortgages reduce, more of your regular payment is applied to your principal. Furthermore if rates enhance, more of your settlement will approach the interest. However, this threat of default is removed if you make a down payment within a particular range, especially in between 5% and also 20%. Making a deposit much less than 20% makes it a high-ratio mortgage, which is needed to have home loan default insurance coverage. This can add on from 2.80% to 4.00% of your home mortgage amount in home loan default insurance policy costs.

In some cases individual situations adjustment as well as you find on your own in a circumstance where you wesley inc require to damage your mortgage term early. There are a number of reasons you can need to break your mortgage term, including moving, a re-finance or an additional life event. If you damage your home mortgage term early, you may incur a substantial early repayment charge cost.